We compare all invoice financing options to make sure you get the right product for your business

Unsure which invoice finance product is the right one for your business? We compare the best invoice financing options available to get you the best deal. Get a quote online or call us on 0808 250 0859 to speak to one of our cashflow finance experts.

On this page

Pages in this SectionWhat is Invoice Finance?

It enables businesses to release a percentage of their invoice's for an immediate cash flow boost, usually within 24 hours.

Types of Invoice Finance

- Invoice Factoring: Sell your invoices to a factoring company and receive an advance. The factoring company handles collections.

- Invoice Discounting: Retain control over collections and receive an advance on your invoices from a finance provider.

- Selective Invoice Finance: Choose specific invoices to finance, providing flexibility and control.

How Does Invoice Finance Work?

- Issue Invoices: Send invoices to your customers as usual.

- Submit to Finance Provider: Submit the invoices to your finance provider.

- Receive Advance: The provider advances up to 90% of the invoice value, typically within 24 hours.

- Customer Payment: Customers pay their invoices directly into a bank account managed by you or the finance provider.

- Balance Payment: Once the customer payment is received, the finance provider releases the remaining balance, minus their fees.

Advantages of Invoice Financing

Faster Access to Cash

Receive funds almost immediately compared to traditional loans.

Less Stringent Requirements

Approval is often based on the creditworthiness of your customers.

Scalability

As your sales grow, the amount of finance available increases proportionally.

Maintain Equity

Unlike equity financing, invoice finance doesn't require giving up a portion of your business. You retain full ownership and control.

Improves Negotiation Power

With better cash flow, businesses can negotiate better terms with suppliers, potentially securing discounts for early payments.

Access to Expertise

With Novuna as your invoice finance company, you'll get access to our wealth of knowledge and expertise for any cash flow management queries as well as support finding the right invoice finance product for your business.

Why Choose Us for Small Business Invoice Financing?

At Novuna, we understand the unique needs of small businesses. Our invoice financing solutions are designed to provide fast, flexible, and reliable access to funds, helping you manage cash flow effectively and focus on growing your business. Our team of experts is here to support you every step of the way, ensuring you get the best financial solution tailored to your needs.

Invoice Financing for SMEs

- Tailored for SMEs: Invoice finance is particularly beneficial for small and medium-sized enterprises (SMEs) that may face cash flow challenges. It provides a reliable source of working capital without the need for traditional bank loans.

- Fast and Flexible: The application process for invoice finance is usually faster and more flexible compared to conventional loans. This speed is crucial for SMEs needing quick access to funds.

- No Asset Requirement: Unlike other forms of financing that may require collateral, invoice finance only relies on your outstanding invoices, making it accessible to businesses without significant assets.

- Boosts Credibility: Using invoice finance can enhance your business's credibility with suppliers and customers, as it demonstrates sound financial management and ensures timely payments.

Benefits of Invoice Finance

Improved cash flow

Immediate access to cash helps cover operational expenses and invest in growth opportunities.

Reduced credit risk

Finance providers often take on the risk of customer non-payment, especially in non-recourse arrangements.

Outsourced Credit Control

For factoring, finance providers handle collections, freeing up your time to focus on business operations.

Flexibility

Choose the type of invoice finance that best suits your business needs.

Invoice Finance Example

Invoice finance application

Sarah’s Interiors Ltd needed to finance a large project

90% of invoice value released

By using invoice finance, Sarah was able to access 90% of a £5,000 invoice upfront

Funds provided

This provided the necessary funds to purchase materials and hire additional staff which meant she was able to complete the project on time and secure further contracts.

Why Choose Us As Your Invoice Finance Company?

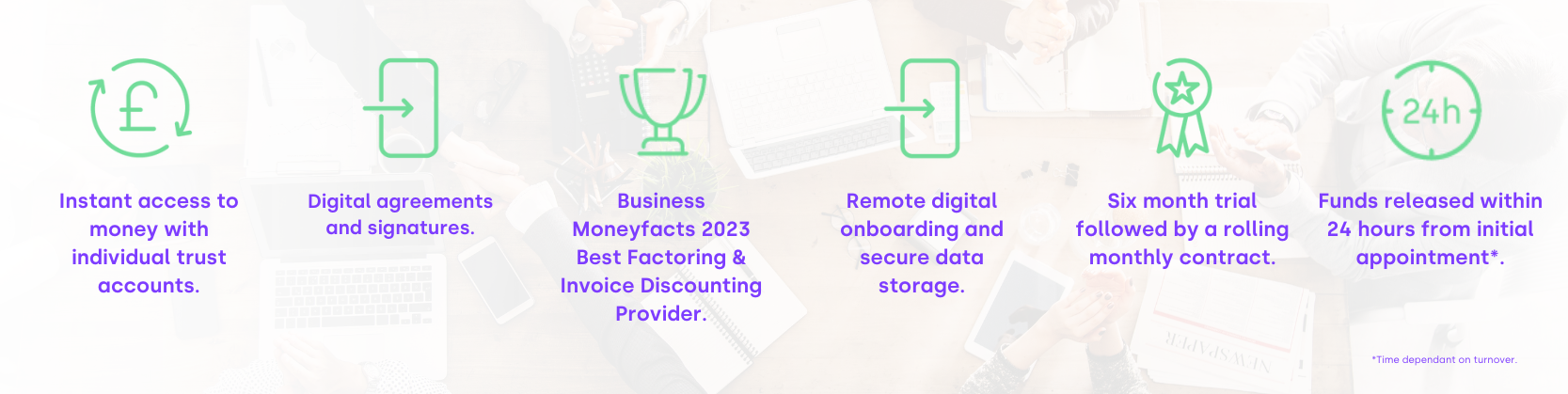

6 month trial period

![]()

A 6 month trial period so you can be sure the product is right for you, followed by a 6 month rolling contract – we don’t tie our clients in for long periods.

Digital onboarding

![]()

We are the first in the market to offer a digital onboarding process and have been leading the way with our digital capabilities allowing clients to sign up within 24 hours from the first appointment.

Client trust account

![]()

Once you become a client you will be given your own trust account, meaning you will get same day availability on your funds. You can also view all of your invoices and payments online at a time suitable to you, 24/7.

No uncleared effects

![]()

We have heavily invested in our digital capabilities. This includes the auto allocation of payments using Artificial Intelligence. Ultimately this advance in technology means that our clients access money quicker as well as saving money on interest charges due to auto allocation.

Simple pricing

![]()

We aim to make the process of Cash Flow finance as simple and straightforward as possible. Our pricing is very straightforward to understand. For a no obligation quote or an informal chat you can call our friendly team today on 0808 250 0859.

Award winning service

![]()

We offer award-winning client services and individual Relationship Managers who are on the other end of the phone or out in the field to visit you in person.

Award Winning Invoice Finance Facility

Highly Recommended by Our Customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsRelated Invoice Finance Articles

Invoice Financing FAQs