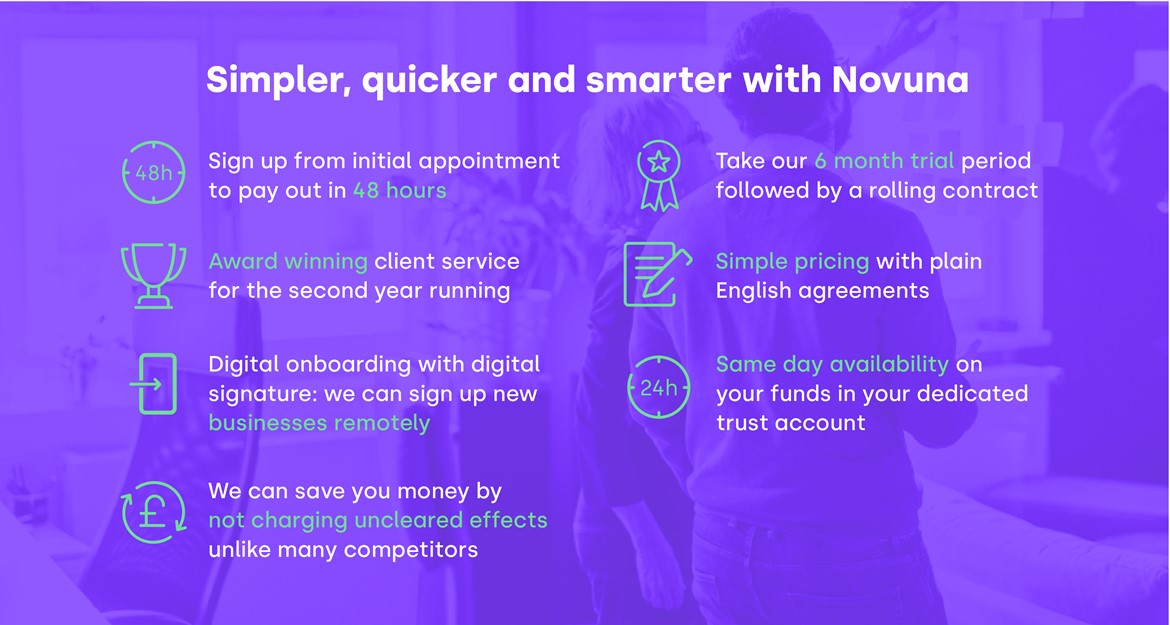

Why choose Novuna as your business cash flow company?

We are a multi-award winning cash flow funding business

Are you looking for a cash flow loan solution for your business and can't decide which company to choose? Here are just some of the benefits of choosing Novuna Business Cash Flow as your cash flow loan provider:

-

Revolutionary digital onboarding with digital signature means we can sign you up within 24 hours of your first appointment

-

Take our 6 month trial, followed by a rolling contract, we don’t tie you in to long contract periods

-

You will receive same day availability on your funds with your dedicated trust account

-

A simple and transparent fee structure with no hidden costs

-

Winners of the 'Best Factoring and Invoice Discounting Provider' at the 2023 Business Moneyfacts Awards.