Reverse Factoring

Understand how reverse factoring works and whether it's the right finance solution for your business.

Boost your cash flow with reverse factoring

We compare all factoring options for you, so you can rest assured you'll get the right product and the best deal for your business. Get a quote online or call us on 0808 250 0859 to speak to one of our invoice factoring experts.

Quick links on this page

Pages in this SectionWhat is reverse factoring?

Reverse-factoring is a financing option where a 3rd party financial provider finances the supplier on behalf of the buyer.

Reverse-factoring is initially set up by the buyer who ensures the supplier is on board. The buyer receives the order from the supplier and approves the invoice. The supplier then sells the unpaid invoice to the financial provider at a discounted rate.

How does reverse factoring work?

1

Reverse-factoring is initially set up by the buyer who ensures the supplier is on board. The buyer receives the order from the supplier and approves the invoice.

2

The supplier then sells the unpaid invoice to the financial provider at a discounted rate.

The financial provider will then advance up to 100% of the value of the invoice to the supplier immediately.

3

The buyer, who has negotiated terms with the finance provider to increase the time it gets to fulfil the invoice, then pays the financial provider the value of the invoice plus interest on its maturity.

Advantages of reverse factoring

What is the difference between reverse factoring and invoice financing?

Reverse factoring

- Reverse factoring involves a finance provider paying up to 100% of a outstanding invoice to the supplier of the goods or services that have been delivered to a buyer.

- The buyer pays back the finance provider on maturity of the invoice plus interest.

- It is the buyer that sets up the arrangement with the agreement of the supplier.

Invoice financing

- Invoice financing involves a finance provider loaning up to 90% of an outstanding invoice to the supplier of the goods or services that have been delivered to a buyer. The supplier is responsible for chasing up the invoice from the buyer and paying back the finance provider.

- It is the supplier that sets up the arrangement and the supplier that pays the fee for the service.

- The buyer doesn’t need to be aware of the loan and pays the invoice as normal to the company on maturity.

Why choose Novuna Business Cash Flow?

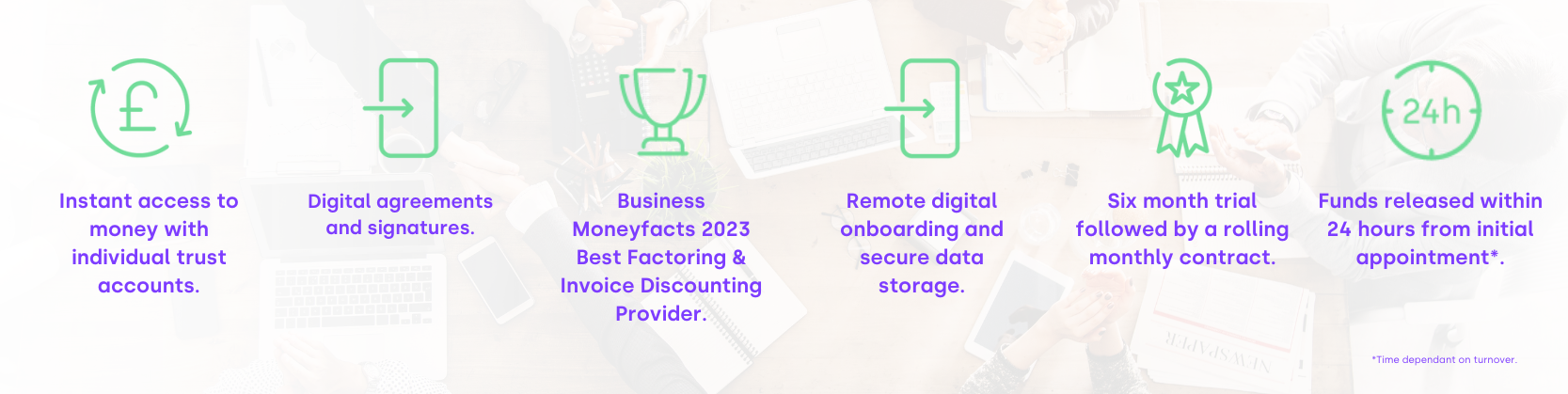

6 month trial period

![]()

A 6 month trial period so you can be sure the product is right for you, followed by a 6 month rolling contract – we don’t tie our clients in for long periods.

Digital onboarding

![]()

We are the first in the market to offer a digital onboarding process and have been leading the way with our digital capabilities allowing clients to sign up within 24 hours from the first appointment.

Client trust account

![]()

Once you become a client you will be given your own trust account, meaning you will get same day availability on your funds. You can also view all of your invoices and payments online at a time suitable to you, 24/7.

No uncleared effects

![]()

We have heavily invested in our digital capabilities. This includes the auto allocation of payments using Artificial Intelligence. Ultimately this advance in technology means that our clients access money quicker as well as saving money on interest charges due to auto allocation.

Simple pricing

![]()

We aim to make the process of Cash Flow finance as simple and straightforward as possible. Our pricing is very straightforward to understand. For a no obligation quote or an informal chat you can call our friendly team today on 0808 250 0859.

Award winning service

![]()

We offer award-winning client services and individual Relationship Managers who are on the other end of the phone or out in the field to visit you in person.

We are an award winning invoice finance company

We come highly recommended by our customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll."

Read full reviewThe factoring process has been revolutionised with our digital onboarding process

Get in touch today

Contact our friendly UK advisors on our freephone

0808 250 0859

8:45 - 17:15 - Monday to Thursday &

8:45 - 16:45 - Friday

More factoring products from Novuna Business Cash Flow

Want to learn more about how you can boost your businesses cash flow?

Our Cash Flow Resource Hub has been set up to help SME's with cash flow finance advice, tips and resources to help with their cash flow position.

We explore ways you can begin improving your cash flow situation and start getting your business on track to positive cash flow.