Understanding cash flow financing

Our Cash Flow Financing Resource Hub has been set up to help SME's with cash flow finance advice, tips and resources to help with their cash flow position. We explore ways you can begin improving your cash flow situation and start getting your business on track to positive cash flow.

Are you looking for a way to improve you business cash flow?

Get a quote online or call us on the freephone number below to have a chat with one of our cash flow financing experts.

On this page

Pages in this SectionWhat is cash flow finance?

Cash flow financing is a method that enables businesses to leverage their expected cash flows to secure funding from a finance provider. Essentially, it involves obtaining a loan based on the cash flows that a business generates, using these future cash flows as a means to repay the loan.

Cash flow represents the movement of money into and out of a business, making cash flow financing a strategic option for businesses looking to unlock additional cash without needing physical assets as collateral.

A key challenge that many businesses face is the delay between providing services or delivering goods and receiving payment for these, often ranging from 30 to 90 days. Late invoice payments can exacerbate this issue, leading to significant financial strain. To mitigate these challenges and improve working capital, many businesses turn to Invoice finance as a straightforward and rapid solution. However, cash flow financing offers an alternative by focusing directly on the anticipated cash flows of the business.

How does cash flow financing work?

Cash flow financing works by providing businesses with a loan that is specifically intended to be repaid through the future cash flows the business generates. Here's a step-by-step overview of how it operates:

- Assessment of Cash Flows: A finance provider evaluates the business’s past and projected cash flows to determine the amount of funding that can be safely provided.

- Loan Agreement: Once the provider is confident in the business's cash flow stability and projections, they offer a loan. The terms of this loan, including interest rates and repayment schedules, are tailored based on the assessed cash flow.

- Funding Provided: The business receives the loan, which it can use to cover various needs such as operational expenses, investment in growth, or smoothing out cash flow inconsistencies.

- Repayment: The business repays the loan over time, with payments scheduled according to the predicted cash flow. This often includes a portion of the interest and principal with each cycle of cash flow.

This financing method is particularly appealing for businesses without significant physical assets but with strong cash flow projections. It allows for more flexibility than traditional loans, which might require tangible collateral. Moreover, cash flow financing can be an excellent tool for businesses that experience seasonal sales fluctuations or have growth opportunities that exceed their current cash reserves.

Why would a business need cash flow finance?

Cash flow is one of the biggest financial challenges that any small business will face. Without readily available cash, it can be really hard to push on and grow the enterprise, and in severe cases, it can even threaten the viability of the business. This happens when cash flow is so poor that there are few funds available for things like payroll, rent, and other essential monthly commitments. But what some of are the biggest problems with cash flow for small businesses?

What are some ways to solve cash flow financing problems?

Cash flow finance is widely understood to be the lifeblood for businesses both small and large. Without it, it can be difficult to meet those monthly commitments, such as rent, wages and product costs. Unfortunately, it’s very common for SMEs to have cash flow problems, arising for all manner of reasons. Fortunately, there are a few different ways to improve cash flow:

Are slow invoice payments causing you cash flow funding problems?

Release up to 90% of the invoice straight away with our invoice finance solutions.

Get in touch

Contact our friendly UK advisors on our freephone

0808 250 0859

8:45 - 17:15 - Monday to Thursday &

8:45 - 16:45 - Friday

Useful resources for businesses

Cash Flow Terms

In our Cash Flow terms section, we will explore them all in more detail and offer advice as well as lots of useful resources along the way.

Invoicing Explained

Invoicing is essential for small businesses. They are the business documents that enable companies to be paid for their services. A popular way to get started with invoices are to use invoice templates.

Finance Terms

It's important to understand all the key financial terms when running a business. To help, we’ve put together the most common terms in you're likely to come across as an SME and how to understand them for future use

Business Cash Flow Loans

Put simply, a business loan is where a sum of money is lent to a company over a period of time, and the monthly payments and interest rate are fixed over the agreed term. Business loans help your cashflow position and can be extremely helpful for a business by offering a short term finance option.

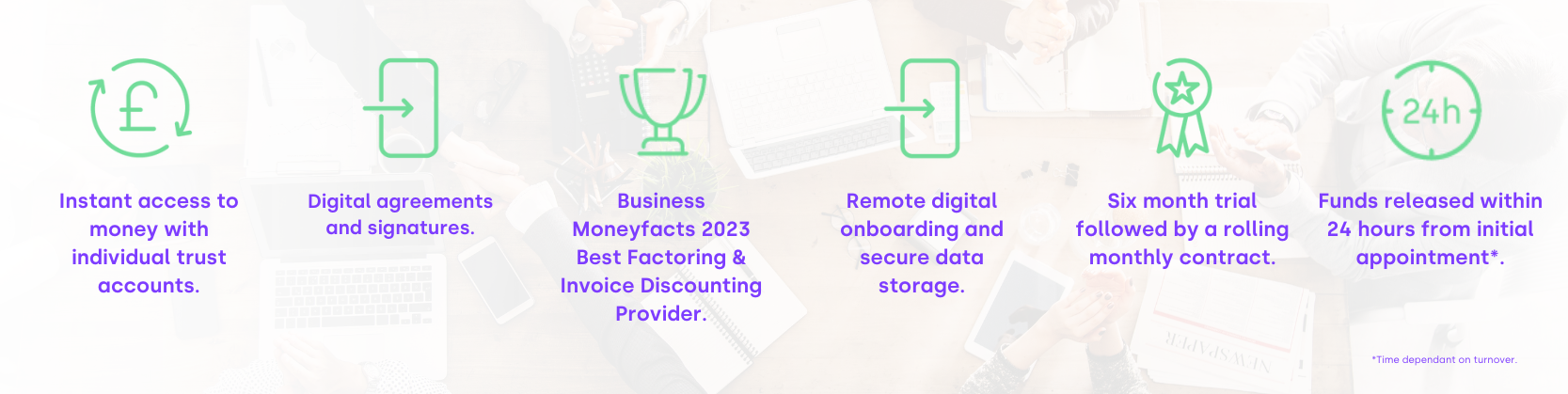

Our digital onboarding process has revolutionised cash flow financing in the UK

Cash flow insights from the blog

Have you thought about invoice finance as a cash flow finance solution for your business?

Invoice finance allows you to release cash quickly from your unpaid invoices.

As your lender, we can release up to 90% of your invoices within 24 hours. On payment of the invoice from your customers, we will then release the final amount minus any fees and charges. There are different types of invoice financing options available to businesses depending on the situation and the level of control they require in collecting unpaid invoices.

Invoice financing products from Novuna Business Cash Flow:

Invoice Factoring

Invoice Discounting

Payroll Finance

Credit Protection