Other sections in this guide:

What is block discounting?

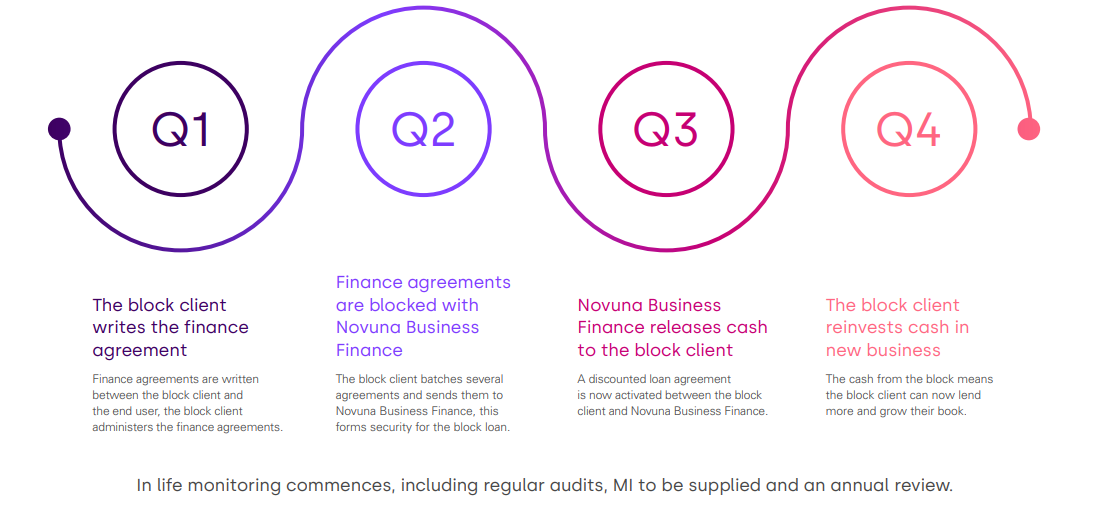

Firstly what is Block discounting and how does it work?

Simply put, the finance company (in this example Novuna Business Finance) buy the rights to the finance agreements including the right to receive all the payments (known as Receivables) that the Customer is obliged to pay.

The Block customer, along with the funder continues to be responsible for any obligations to the Customer under the finance agreements and you also remain the owner of the assets that relate to the finance agreements – the finance company take a fixed charge over those assets. The finance company will appoint you as their agent to collect the Receivables.

You must pay the finance company a certain amount (referred to as the Minimum Sum) of the Receivables each month (even if you do not receive the Receivables from the Customer) and provided you continue to pay the finance company the Minimum Sum for an agreed term (usually 36 months), you can keep any surplus Receivables over and above the Minimum Sum.