The Annual Investment Allowance

What is the Annual Investment Allowance?

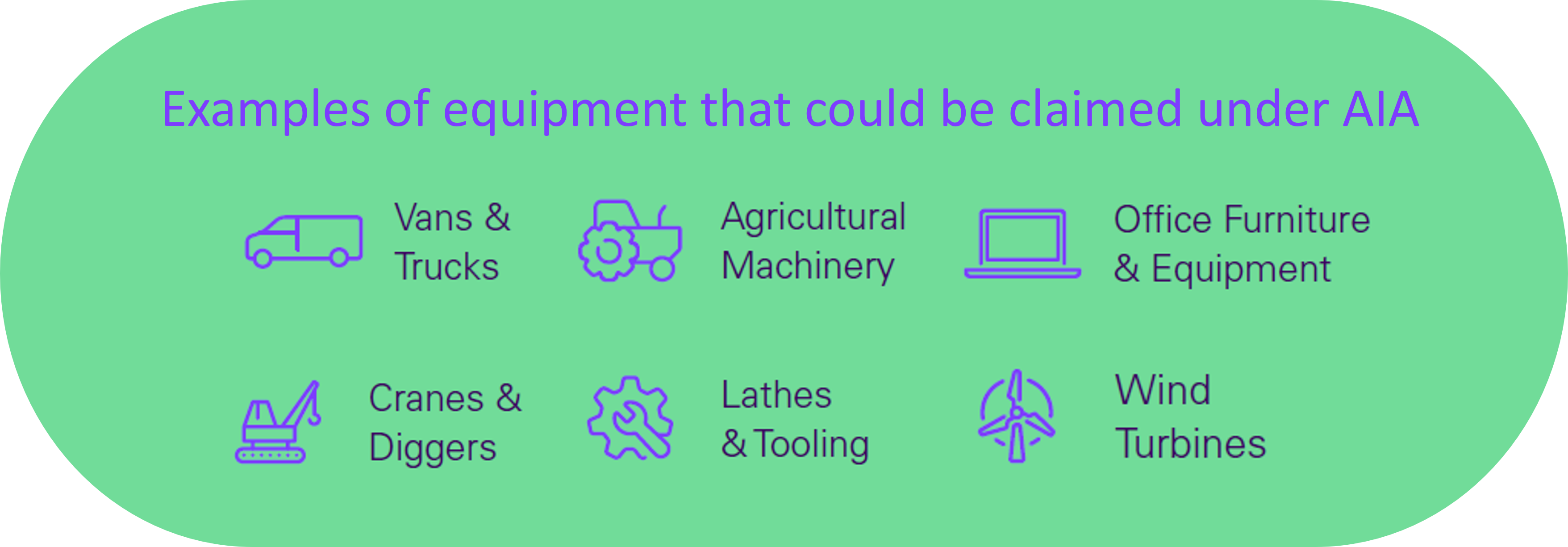

The Annual Investment Allowance (AIA) is available for all businesses as a means of reducing the cost of capital. It allows businesses to deduct the full cost of investment in qualifying plant and machinery up to the annual limit of £1m for each accounting period.

This has a direct impact on the financial results for those businesses investing in qualifying expenditure as up to £1million could be deducted from taxable profits – a significant amount!

More information on the categories of qualifying expenditure can be found here.

Disclaimers

- HMRC have made changes to the AIA rate since its inception in 2008. You will need to ensure that you are claiming the correct rate for the period you are claiming for. Visit the HMRC website for more information about AIA.

- The availability and amount of any tax reliefs will depend on a businesses individual circumstances. The details referred to above apply to current legislation which may change.

- Novuna and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Let's talk - we're here to help

If you're a business and are interested in one of our services, please fill in the contact form below and a member of our team will be in touch. Credit is subject to status.

We'll only be able to assist you if meet the minimum criteria:

- A UK based Limited Company, Public Limited Company, Limited Liability Partnership, Sole trader or Partnership

- Have been trading for a minimum of three years

- Looking for Hire Purchase or Leasing agreements