Small Business Growth Predictions: 2014-2022

Since October 2014, the Business Barometer study has tracked the growth outlook of UK small business owners by exploring owners’ confidence levels.

With our 30th quarterly cycle of tracking research complete, this chapter examines small business growth forecasts over time. Every quarter we have asked a representative sample of more than 1,000 small business owners what their growth outlook has been for the next three months. Respondents are allowed to indicate one of five responses: two levels of positive growth—significant or modest; no change for the next three-months; or two levels of decline—either downsizing or struggling to survive.

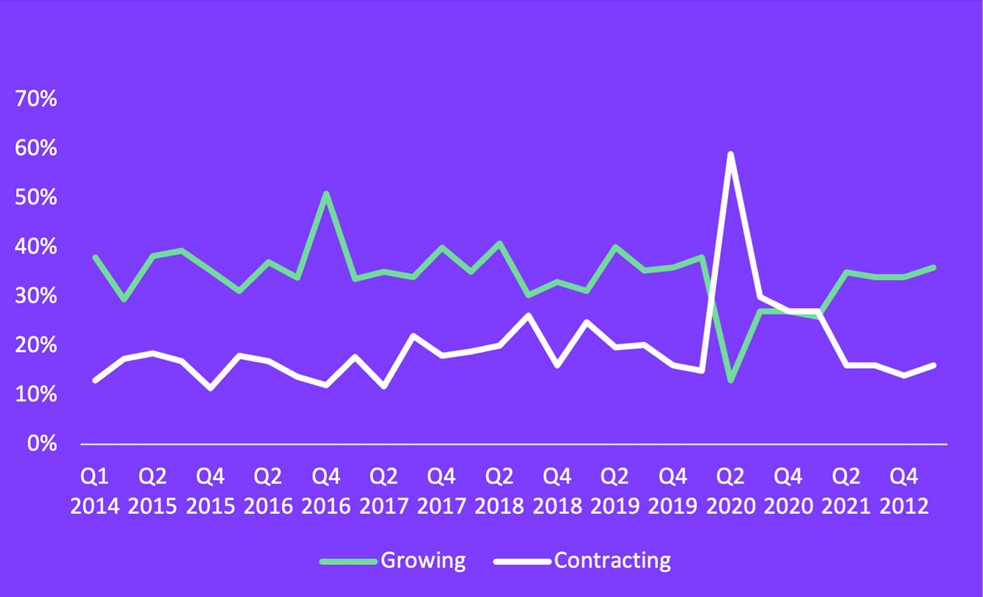

Net percentage of small businesses predicting significant or organic growth by quarter

Throughout the course of our research backdrop was one of constant change – from elections and referenda, the uncertainty of Brexit right up to the pandemic. During this time, the quarterly growth outlook of small business owners since 2014 has been remarkably bullish and consistent. Over 30 consecutive quarters, the proportion of small business owners predicting growth for the three months ahead has ranged from 38–45% with few variations. In the same period, 40–50% of small businesses have predicted ‘no change.’

Over three-quarters of all small businesses surveyed, then, remained steady or predicted growth, suggesting a bedrock of consistency underpinning business planning. Notably, the percentage of enterprises anticipating contraction or collapse has consistently remained in single figures—apart from Q2 2020, when Covid-19 arrived in the UK.

Fluctuations from the trend: Political and Brexit uncertainty

Before Covid-19, there were only two meaningful deviations from the steady trend of consistent growth forecasts, and both relate to macro-economic uncertainty following significant political change.

In Q3 2016, the result of the Brexit referendum—and Prime Minister David Cameron’s sudden resignation—triggered an immediate fall in small business confidence. For the first time in eight consecutive quarters, the percentage of small business owners predicting growth fell from the early 40s to 32%—with the percentage of those predicting ‘no change’ hitting a two-year peak of 52%. This was, perhaps, an early indication that small businesses responded to political and economic uncertainty by revising growth plans and sitting tight until a clear economic picture emerged .

In the following year, Q2 2017, economic uncertainty about the General Election, with Brexit uncertainty to the fore, also resulted in a dip in small business outlook. The percentages of business owners predicting growth fell from the mid-40s to 35% and, once again, the percentage of enterprises predicting no change rose to 52%. From Q3 2018, the percentage of small businesses predicting growth slipped a little and stayed low for 18 months. The once regular level of 40–45% of small businesses predicting some form of growth settled at the mid-30s. Brexit uncertainty dominated the headlines and, with many enterprises having links to the EU, the slight revision in overall growth forecasts is understandable. Nevertheless, given that at the start of 2020, most small businesses (55%) said they were in favour of remaining in the EU, and that 48% reported they could see no business opportunities resulting from Brexit, the overall downward revision of growth forecasts is relatively small. Small business owners in general adjusted, and the overall trend of steady growth predictions continued.

This data suggests that smaller enterprises are generally more adaptable and agile in the face of change than many of their bigger counterparts. This certainly proved true when Covid-19 struck in March 2020.

The impact of Covid-19 on growth predictions

Every aspect of UK life changed when Covid-19 hit, and the country went into the first of many national lockdowns. After 22 quarters of consistent growth forecasts, small business growth forecasts crashed in April 2020 from a steady average of 35% to just 13%. Simultaneously, the percentage of small businesses predicting contraction (30%) or collapse (29%) rocketed into double digits for the first time in years.

Despite this shock, the two-phase bounce back was impressive. In Q3 2020, the percentage of small businesses predicting growth doubled to 27%, and it stayed at this level for the next three consecutive quarters. In Q2 2021, confidence rose further to 36%—its pre-Covid-19 level—and has remained there.

Two takeaways emerge from this bounce-back data:

-

After the first lockdown, small businesses adapted quickly

Many worked from home, embraced technology, and/or re-purposed their business. These factors

enabled many small businesses to remain open and re-forecast growth plans—albeit at a lower

level than the pre-pandemic years.

-

Confidence bounced back quickly

By April 2020, business growth predictions had returned to their pre-Covid levels and have been

maintained—even with the recent Plan B restrictions of Christmas 2021 confidence overall continued to grow, reaching the same levels seen pre-pandemic for the first time in Q1 2022.

The speed with which small businesses adapt and their ability to recover from economic shocks underline their importance to the overall UK economic recovery after Covid-19. Consistency, agility, and determination are what the UK economy needs to rebuild consumer confidence—and the small business sector is already demonstrating these attributes.

Analysis of small business growth outlook since 2014 also reveals thematic trends, when comparing small business respondents by size, age, sector, and region.

Business outlook by size

For this analysis the relative size of businesses was defined by turnover, rather than employee number.

From 2014, smaller businesses in their first year of trading were more agile than their larger, more established, counterparts. Around two thirds of small business owners consistently predicted growth for the three months ahead—a far higher percentage than businesses with a turnover of 1-10 million, where around one in two predicted growth. After economic shocks, smaller businesses proved resilient, bouncing back in mid-2019 from the 18-month dip in confidence aligned with Brexit uncertainty. Smaller businesses were also the hardest hit by advent of Covid-19—growth forecasts falling to 11%—but by Q2 2021, they had quickly and emphatically bounced back to pre-Covid levels.

In contrast, larger enterprises have had more frequent blips in confidence. Disruption from Covid-19 has had a longer-term impact: although larger businesses’ confidence has recovered, to this day it has not returned to pre-pandemic levels.

While start-up businesses inevitably have a strong growth agenda, the research data does suggest that small businesses find it easier to adapt.

Business outlook by age

Younger businesses were more consistently likely to have confident growth outlook (typically ranging from 45%–50% since 2014) than older businesses (ranging more broadly between 24%-38%). Younger businesses’ growth forecasts were less affected by Covid-19 and they bounced back to pre-Covid levels more quickly.

Younger businesses are usually smaller, which probably makes it easier for them to adapt and re-forecast. However, the research suggests there are more factors than size. Younger businesses are more likely to be run by younger owners, who are more likely to deploy the latest technology to make their business more efficient and agile. For example, at the start of 2021, leaders of smaller businesses were most likely to say they had used technology to positively support their business (78%) in providing a faster service (27%), cutting down travel time to meetings (26%), improving productivity (23%), and reducing office overheads (19%).

Business outlook by region

Business outlook is currently most confident in London and the South East. However, prior to 2018, business growth outlook across the regions was more closely aligned. Covid-19 precipitated a universal plunge in business confidence—most deeply felt by small businesses in Scotland and Wales—but the bounce back shows greater variance in confidence levels across the regions.

This trend should be monitored closely in 2022. The outcome will inform whether, post-Covid-19, the small business sector can be seen as a national community, or whether greater attention needs to be given to supporting rebuild and recovery on a region-by-region basis.

Business outlook by sector

A more detailed assessment of key industry sectors is shared in Chapter Three of this report, but an overview specifically looking at growth outlook presents an interesting picture over time. From 2014–17, growth forecasts varied widely by sector as businesses reacted to sector and seasonal issues. When the UK entered the 18-month period of Brexit uncertainty, confidence overall fell a little, but there was greater consensus by sector.

When Covid-19 struck in early 2020, positive-growth outlook fell sharply across sectors. The initial bounceback was relatively even but, as 2021 progressed, variance grew again between the sectors. This may suggest some sectors were able to rebuild faster than others, but it is possibly also a sign of overall sector recovery because the sector-by-sector picture is showing signs of returning to the pre-Brexit era.

Sector growth outlook: The impact of Covid-19 hitting the UK, and the return to pre-Covid confidence levels in most sectors by the end of 2021

Growth outlook by trading status

Analysis suggests that, after Covid-19 struck, small business growth forecasts took 12 months to recover to pre-Covid levels and have now enjoyed nine (12 in Q1) months of stability.

During the first wave of national lockdowns, many small businesses had to fundamentally review their trading status. Some were unaffected whilst others, tragically, had to close temporarily. Big adjustments also had to be faced as thousands of enterprises geared up for home working, whilst others re-engineered their business by diversifying and offering new services.

The table below shows that, by the start of 2021, trading status had a direct bearing on the percentage of small businesses predicting growth. By the second half of 2021, growth forecasts were healthy across the categories—with even those that had closed or re-purposed reporting strong growth plans. Perhaps this is the ultimate indication of full and sustainable recovery and confidence returning to the sector.

Concluding remarks

“The growth outlook of UK small business owners is a strong indication of confidence levels. One can feel confident without predicting business growth, where is predicting growth is built on confidence. Against the backdrop of high levels of uncertainty which have persisted throughout the course of our research, it is somewhat remarkable that such a consistently high proportion have remained optimistic about their growth outlook.

Particularly after such unprecedented levels of uncertainty during the past two years, all will be hoping for a period of calm after the storm – a chance to draw breath, and make plans longer term plans, and gradually build momentum. Battling the elements has used up vital energy and reserves – a period of stability is needed to replenish them.”

Jo Morris, Head of Marketing & Insight, Novuna Business Finance

You can download the full Business Barometer Report 2022 here.