Environmental grants, reliefs and schemes: have you looked into environmental taxes, reliefs and schemes for your business?

Businesses today are constantly striving to become more environmentally friendly and seeking out ways to create sustainable practices and products.

Alongside the UK government’s sustainability plan, business owners could expect to make financial savings as they take advantage of environmental taxes, reliefs and schemes for business.

Depending on the type and size of your business, you may be eligible for different payments and savings allowing you to perform in a more sustainable way.

What are environmental taxes and schemes?

Designed to encourage businesses to operate in a more environmentally friendly way, environmental taxes vary with the size and type of business.

There are some key circumstances when you may be exempt from some taxes including:

- If you use a lot of energy due to the nature of your business

- If you do not use much energy due to the size of your business

- If you show evidence of purchasing energy-efficient technology for your business

By applying for environmental schemes your business will be seen as demonstrating a desire to operate more efficiently and seeking to produce waste that is less harmful to the environment.

Where to start

It can feel daunting when you start to research what kind of environmental grants, reliefs and schemes your business may be eligible for. However, there is lots of useful advice out there to help you.

Firstly it’s helpful to get some general advice regarding how you can increase the energy efficiency of your business. Have a look here to get help directly from the National Energy Foundation.

You should also seek to get as much independent advice as possible to enable you to make informed choices about the best options for your business. The Energy Savings Trust has some great resources.

If you’re looking at buying new equipment to increase your energy efficiency, you’ll want to check out the GOV.UK’s extensive list which details which products may be covered under various schemes.

Understanding environmental taxes

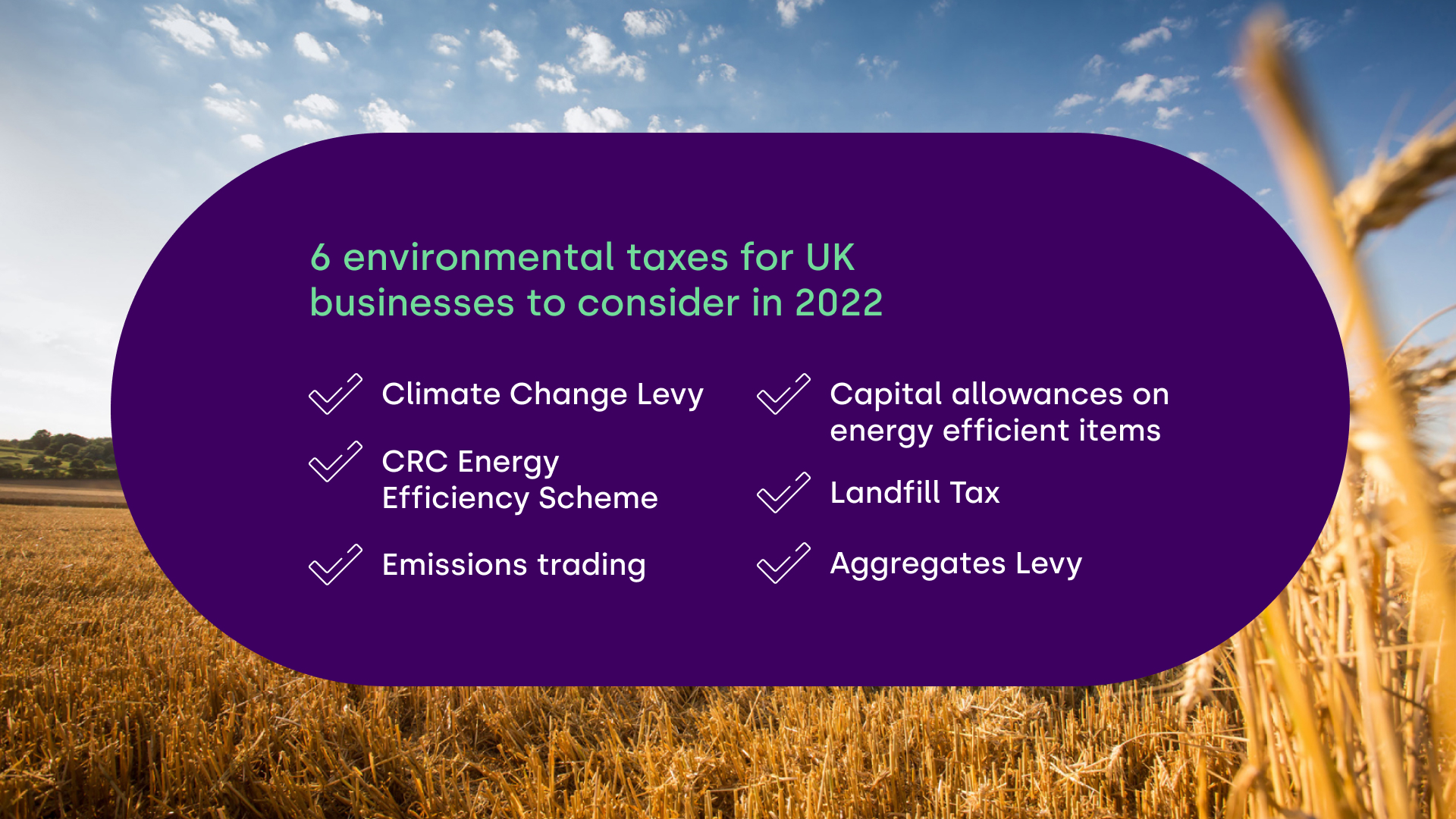

Let’s take a look at the most relevant environmental taxes for businesses in the UK in 2022:

Climate Change Levy

This is an environmental tax that is charged on the energy (electricity, gas and solid fuel) that a business uses.

The Climate Change Levy applies to businesses in the following sectors:

- Industrial

- Public Services

- Commercial

- Agricultural

Charities and businesses consuming minimal amounts of energy are generally exempt from paying main CCL rates.

Designed with the aim to encourage businesses to be more energy efficient, The Climate Change Levy also seeks to help them to reduce their overall emissions. It can be paid at either the main rate or the carbon price support rate.

CRC Energy Efficiency Scheme

This scheme specifically targets larger, energy intensive organisations in both the private and public sectors in the UK.

It aims to encourage businesses to become more energy efficient and to cut their carbon dioxide emissions.

Emissions trading

This scheme (often referred to as ‘cap and trade’) was designed to incentivise firms to reduce their emissions. The government is able to set a cap on the maximum level of emissions created.

With efficient planning, an Emissions Trading Scheme can deliver additional benefits such as cleaner air, more efficient resources and the creation of more jobs.

Capital allowances on energy-efficient items

This scheme allows you to claim capital allowance when you buy energy efficient or low/zero carbon technology for your business, thereby reducing the amount of tax you pay.

Some of the items and equipment you can claim for include:

- Electric cars

- Plant and machinery for gas refuelling stations (including tanks and pumps)

- Gas, biogas and hydrogen refuelling equipment

- Equipment for electric vehicle charging points

Landfill Tax

If your business gets rid of waste using landfill sites you can expect to pay this additional tax.

The tax is designed to encourage businesses to seek out ways to recycle waste or dispose of it in more environmentally friendly ways.

Aggregates Levy

This tax was designed to encourage the recycling of aggregate and involves a charge on the commercial exploitation of rock, sand and gravel.

Businesses can expect to pay £2 per tonne of sand, gravel or rock and you will still be required to pay the tax even if the materials are imported.

Other ways to find out about environmental grants, schemes and reliefs for your business

Use your business network

Speak to others within your industry about the type of schemes that they have used and the grants or reliefs which have helped them.

Reach out to others in your business network including your competitors to share your knowledge and encourage them to do the same.

Sustainability thrives on collaboration and community and you could stand to gain valuable information about grants that you could be eligible for.

Speak to your local council

Depending on the type and size of your business you may find it useful to speak to your local council. Often they will have the capacity to provide energy efficient funding or grants to help sustainable business growth.

For most local council grants you’ll be expected to submit a business case or application.

Ask your energy supplier

It’s worth speaking to your energy supplier to see whether they can offer any environmental grants or schemes to help you save money whilst becoming more sustainable as a business.

Some energy companies offer small businesses energy-efficiency schemes or grants depending on your size and business sector.