Tailored finance solutions

When it comes to retail finance, there isn’t a ‘one size fits all’ solution.

Our tailoring options allow us to build finance packages around your customers’ disposable income, providing a personalised, flexible offering whilst always prioritising lending responsibly.

Helping retailers get more customers spending more

Phil Alltoft, Commercial Lead, explains the various tailored finance solutions we offer, and the benefits this can bring to your business.

Ready to find out more?

Tailoring options turn declined applications into accepts

A traditional finance application has just two possible outcomes: accept or decline. And being declined can be frustrating – possibly even prompting customers to walk away from a sale. It’s time to stop saying no to good customers simply because they chose the wrong finance options.

Our tailoring solution allows eligible customers to change their loan amount, term or deposit to create a more affordable payment plan. As a result, we accept more applications, improve accept rates, boost customer satisfaction, and ultimately drive sales.

How it works

- A customer applies for finance but their application is declined. They might have simply chosen a term that’s too short or set a low deposit amount that makes their monthly repayments unaffordable

- Our system automatically decides the maximum monthly payment amount we can offer to that customer. We then suggest alternatives to create a plan the customer can successfully apply for. For example, decreasing the loan amount, lengthening the term or increasing the deposit

- If the customer agrees to the suggested changes, we’ll automatically accept their application. No need for them to reapply, no further impact on their credit score

Buy faster = more profit

We’re all about providing the very best finance option for you and your customers. So, where we can, we’ll offer more favourable terms.

Accepted customers may be able to afford to reduce their loan term, which is faster to pay off and may lower the total cost of borrowing. It could also reduce the subsidy costs you as the retailer will pay us.

We’ll highlight the options during the application journey so customers can make an informed decision before signing their agreement. Plus, with our soft search feature, customers can find out their eligibility with no impact on their credit score.

The feature is also available for your sales team to use in-store too, saving both you and your customers money.

Upfront eligibility before the purchasing journey begins

Soft search allows customers to find out if they're eligible to borrow before they start browsing. We'll even tell customers if they're eligible to borrow more, so they can shop armed with that knowledge with no impact on their credit score.

Our max loan functionality gives your sales team the ideal upsell opportunity, helping to boost sales and increase average order value.

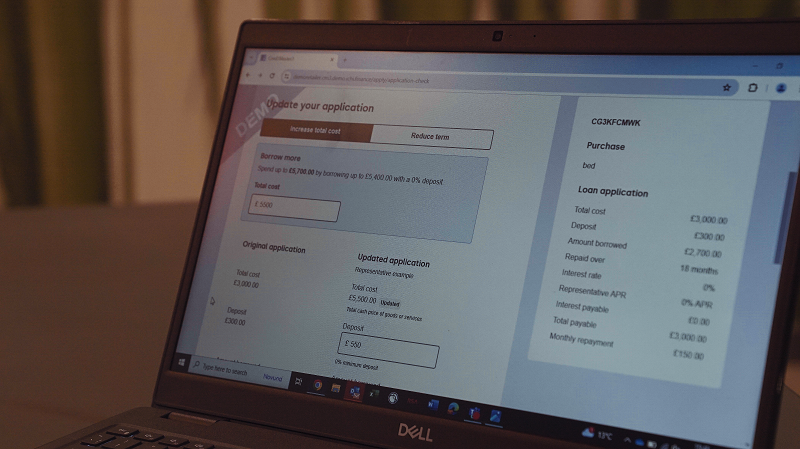

Amend applications at the touch of a button

Customers can update their applications as part of the original journey. But retailers can also amend applications through our CreditMaster3 system, even after a customer has completed and signed their application. There’ll be no further credit checks for your customer, either. Simply click ‘amend’ and make the required adjustments.

This gives your customers greater flexibility should they choose to upgrade a purchase, order more, reduce the loan amount or simply change how long they wish to borrow for.

Make finance work for you and your customers

Ready to partner with a more flexible finance provider? Please complete the short form, and one of our team will be back to you within three business days.

You will need to confirm you can meet all of the following criteria:

- Minimum of £2,000,000 in annual sales turnover OR £50,000 in finance in the last year

- A minimum of 2 years trading history

- Be trading profitably

- A minimum net worth of £25,000, unless your business is within the Home Improvements market then a minimum of £100,000 will be required

- The products you offer are for consumers and NOT for businesses

- You do not offer renewable energy (including solar), dentistry, invasive healthcare, clothing, personal development or training solutions

Retail Partner helpline

If you are an existing retail partner with a general enquiry, please call our Retail Helpline:

0344 375 5515

Retail Helpline opening hours:

08:45 - 18:00 Monday to Friday

08:45 - 18:00 Saturday

10:00 - 18:00 Sunday

Customer helpline

If you're a customer looking to speak to someone about your existing retail finance or personal loan agreement, call our Customer Helpline:

0344 375 5500

Customer Helpline opening hours:

09:00 - 17:00 Monday to Friday

Closed Weekends & Bank Holidays