Growth outlook in the Hospitality and Leisure sector falls amidst cost-of-living crisis

Tuesday 1st November 2022

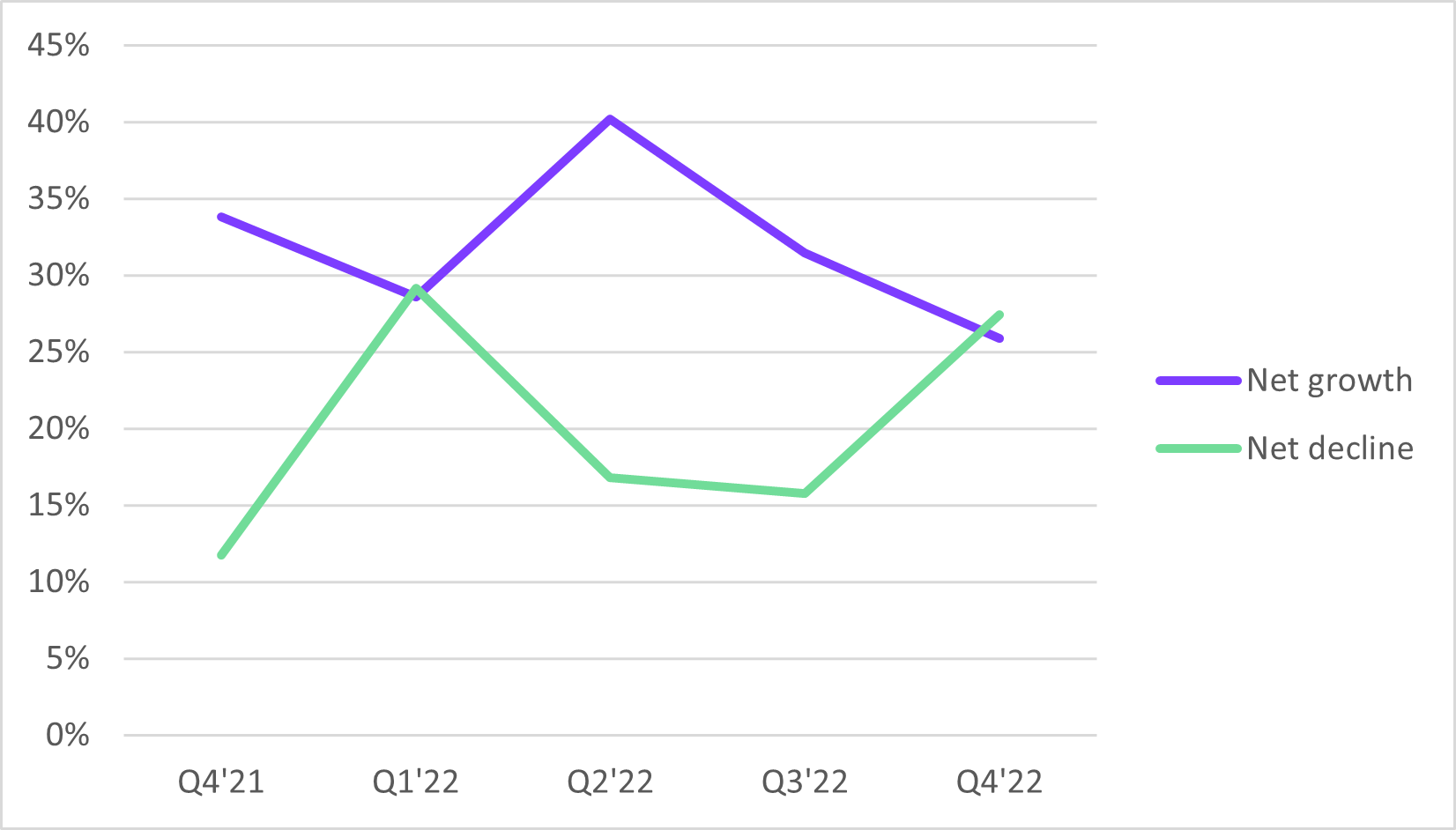

The percentage of UK small businesses in Hospitality and Leisure predicting growth has hit its lowest level in two years (26%) according to Novuna Business Finance.

With the cost-of-living crisis looming, small businesses in the Hospitality and Leisure sector have presented concern with a significant drop in growth predictions on last quarter (31% - down 5%). This is an even further decline than this time last year (34%) when the country was still coping with Covid restrictions.

As UK consumer tighten purse strings, 27% of small businesses in hospitality and leisure fear they will contract or struggle to survive over the next three months - this has almost doubled (27%) since last quarter (16%). These figures have gradually risen quarter-on-quarter through 2022 and the percentage of small businesses fearing for the future is now at its highest level since January 2021. For the second time this year, the proportion of businesses anticipating a period of decline was higher than those predicting growth.

Growth outlook among small businesses in the hospitality and leisure sector

The national average of those UK small businesses predicting growth has also fallen this quarter (31%) from 34% last quarter and 37% this time last year.

The Novuna Business Finance study has been tracking small business growth predictions against prevailing market conditions every quarter since 2015. At the start of each quarter Novuna asks a representative sample of 1,200 small business owners about their growth predictions for the next three months. At a time of unprecedented economic strain and market uncertainty, the contraction of growth predictions is a cause of concern, although the scale of the dip in confidence this quarter is less pronounced than may have been expected.

Across the country, the survey findings by industry sector present a far more mixed picture. In some sectors, small business confidence fell sharply since last quarter although, to some extent, this was offset in other sectors by a greater proportion of business leaders seeing uncertainty as an opportunity to secure growth.

Compared to last quarter, the percentage of small businesses predicting growth fell these sectors: Transport and distribution (falling from 30% to 24%), real estate (falling from 32% to 27%) and hospitality (31% to 26%). There was also a particularly sharp fall in the agricultural sector, where the percentage of enterprises predicting growth fell from 25% last quarter to a current figure of just 11%. In the manufacturing sector, the percentage of small businesses predicting growth held firm on last quarter (35%) - although this remained significantly down on 12-months ago (48%).

We are all very aware of the seismic economic challenges that everyone is facing as we head into autumn and winter months. We were not surprised to see a dip in the proportion of small businesses that are predicting growth in the run-up to Christmas, although the fall was less severe than may have been expected - given the scale of economic volatility and the impact of price rises and inflation on running costs and the supply chain. Whilst in some regions and sectors there are grounds for concern, our findings also suggest there are strong levels of resilience from other businesses. We saw this during the lockdown era, a time many small businesses where quick to adapt their plans, some even re-purposed or re-engineered their businesses at a time of unforeseen change. For many enterprises, the same may be required this winter - and Novuna Business Finance will be there to support established enterprises that are working on plans to adapt, grow and fulfil their potential despite the enormously challenging context.

Jo Morris

Head of Insight

Novuna Business Finance

Growth outlook among small businesses in the hospitality and leisure sector

|

|

Q1'21 |

Q2'21 |

Q3'21 |

Q4'21 |

Q1'22 |

Q2'22 |

Q3'22 |

Q4'22 |

|

Significant expansion |

9% |

8% |

7% |

1% |

0% |

8% |

1% |

2% |

|

Modest organic growth |

47% |

20% |

23% |

33% |

29% |

33% |

30% |

24% |

|

Stay the same/ no change |

18% |

40% |

48% |

46% |

40% |

39% |

50% |

40% |

|

Contract/ scale down |

17% |

7% |

6% |

7% |

14% |

6% |

8% |

17% |

|

Struggle to survive |

9% |

23% |

12% |

5% |

15% |

10% |

8% |

10% |

|

Don't know |

- |

2% |

3% |

8% |

2% |

4% |

3% |

6% |

|

Net growth |

56% |

28% |

30% |

34% |

29% |

40% |

31% |

26% |

|

Net decline |

26% |

30% |

19% |

12% |

29% |

17% |

16% |

27% |

Percentage of small business owners that predict net growth by sector: Quarterly findings and comparisons to a year ago

|

Q4 2022 |

Q3 2022 |

Q4 2021 |

|

|

Media & marketing |

48% |

36% |

47% |

|

IT & telecoms |

40% |

44% |

36% |

|

Finance & accounting |

40% |

44% |

41% |

|

Manufacturing |

35% |

34% |

48% |

|

Legal |

33% |

41% |

40% |

|

Retail |

28% |

20% |

29% |

|

Construction |

27% |

18% |

26% |

|

Real estate |

27% |

32% |

24% |

|

Hospitality & leisure |

26% |

31% |

34% |

|

Transport & distribution |

24% |

30% |

29% |

|

Agriculture |

11% |

25% |

12% |

Note to editors

The research was conducted by YouGov among a representative sample of 1,313 small business decision makers on 4 October 2022, spanning all key industry sectors.