Growth outlook in the transport and distribution sector continues to slide, as contraction proportion rises

Wednesday 2nd November 2022

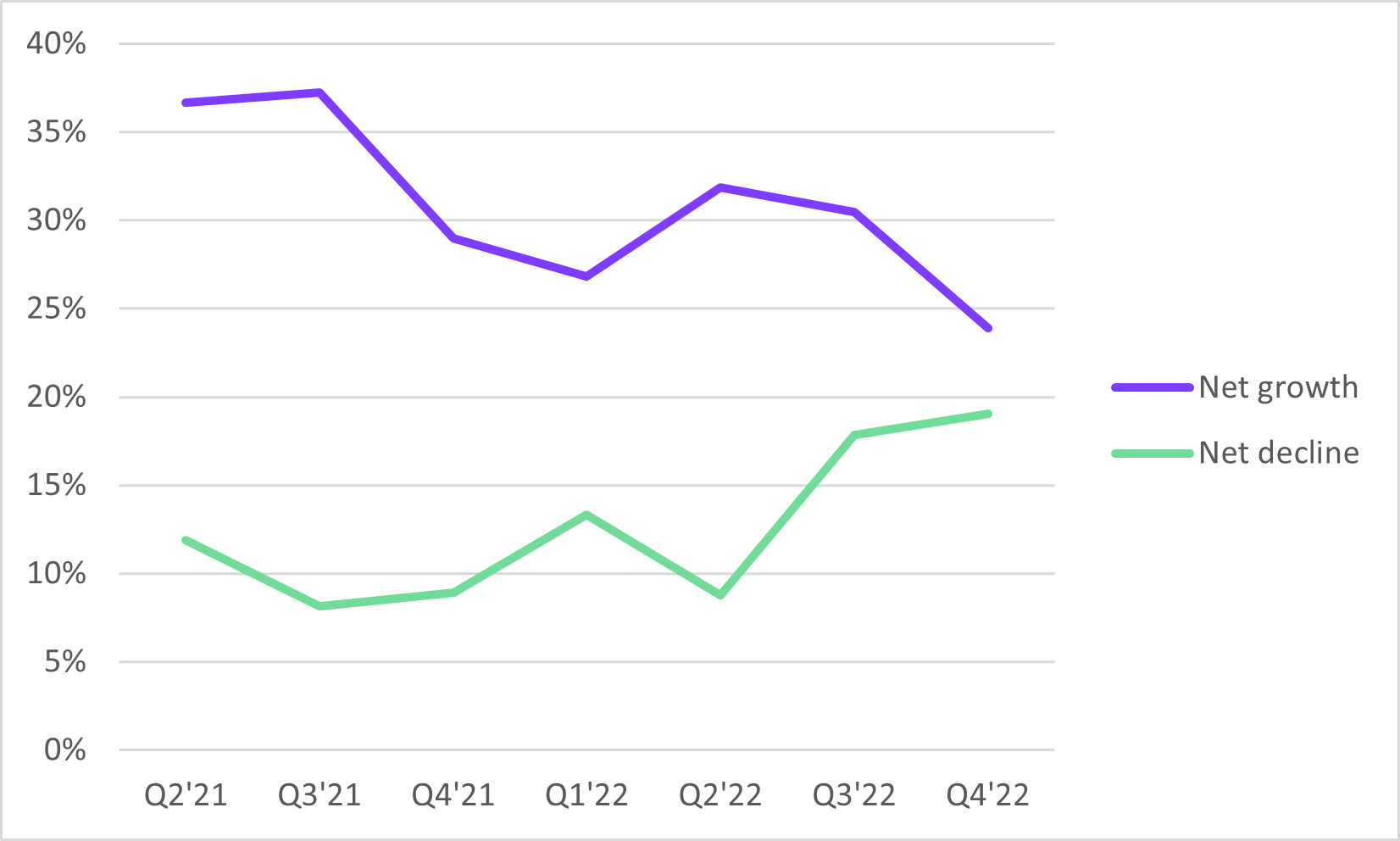

Growth outlook among small businesses in the transport and distribution sector fell this quarter to a three-year low, continuing a downward trend seen since the start of 2021, according to new figures from Novuna Business Finance.

The tracking research of 1,200 small business owners asking about their outlook for the next three months found that the proportion anticipating growth this quarter was 24% - the lowest figure since Q2’20 as the pandemic struck (10%). The proportion this quarter was 6% lower than last quarter (30% in Q3’22), and 4% lower year-on-year (29% in Q4’21).

Meanwhile, the proportion of businesses anticipating decline in the same period – either modest contraction or those struggling to survive – has increased to the highest point in just under 2 years. This quarter, one in six transport and distribution small businesses (19%) predicted some form of decline, a rise of 1% on last quarter (18% in Q3’22), and +10% year-on-year (9% in Q4’21).

Growth outlook among small businesses in the Transport and Distribution sector

At a time of unprecedented economic strain and market uncertainty, the contraction of growth predictions is a cause of concern, although the scale of the dip in confidence this quarter is less pronounced than may have been expected.

By comparison, the percentage of all UK small businesses – across every sector – predicting growth has hit its lowest level in two years (31%), with the latest figures suggest a slight drop in growth predictions on last quarter (34%) and a bigger fall on this time last year (37%) - a time when the country was still coping with Covid restrictions.

In addition, 18% of small businesses fear they will contract or struggle to survive over the next three months. These figures have gradually risen quarter-on-quarter through 2022 and the percentage of small businesses fearing for the future is now at its highest level since January 2021.

Across the country, the survey findings by industry sector present a far more mixed picture. In some sectors, small business confidence fell sharply since last quarter although, to some extent, this was offset in other sectors by a greater proportion of business leaders seeing uncertainty as an opportunity to secure growth. Compared to last quarter, the percentage of small businesses predicting growth fell these sectors: Transport and distribution (falling from 30% to 24%), real estate (falling from 32% to 27%) and hospitality (31% to 26%). In the manufacturing sector, the percentage of small businesses predicting growth held firm on last quarter (35%) - although this remained significantly down on 12-months ago (48%).

We are all very aware of the seismic economic challenges that everyone is facing as we head into autumn and winter months. We were not surprised to see a dip in the proportion of small businesses that are predicting growth in the run-up to Christmas, although the fall was less severe than may have been expected - given the scale of economic volatility and the impact of price rises and inflation on running costs and the supply chain. Whilst in some regions and sectors there are grounds for concern, our findings also suggest there are strong levels of resilience from other businesses. We saw this during the lockdown era, a time many small businesses where quick to adapt their plans, some even re-purposed or re-engineered their businesses at a time of unforeseen change. For many enterprises, the same may be required this winter - and Novuna Business Finance will be there to support established enterprises that are working on plans to adapt, grow and fulfil their potential despite the enormously challenging context.

Jo Morris

Head of Insight

Novuna Business Finance

Growth outlook among small businesses in the Transport & Distribution sector

|

|

Q1'21 |

Q2'21 |

Q3'21 |

Q4'21 |

Q1'22 |

Q2'22 |

Q3'22 |

Q4'22 |

|

Significant expansion |

34% |

9% |

4% |

6% |

4% |

6% |

5% |

2% |

|

Modest organic growth |

12% |

28% |

33% |

23% |

23% |

25% |

25% |

22% |

|

Stay the same/ no change |

29% |

51% |

51% |

58% |

60% |

57% |

50% |

51% |

|

Contract/ scale down |

11% |

3% |

4% |

4% |

7% |

5% |

8% |

11% |

|

Struggle to survive |

15% |

9% |

4% |

5% |

7% |

4% |

10% |

8% |

|

Don't know |

- |

- |

4% |

4% |

- |

2% |

2% |

6% |

|

|

|

|

|

|

|

|

|

|

|

Net growth |

46% |

37% |

37% |

29% |

27% |

32% |

30% |

24% |

|

Net decline |

25% |

12% |

8% |

9% |

13% |

9% |

18% |

19% |

Percentage of small business owners that predict net growth by sector: Quarterly findings and comparisons to a year ago

|

Q4 2022 |

Q3 2022 |

Q4 2021 |

|

|

Media & marketing |

48% |

36% |

47% |

|

IT & telecoms |

40% |

44% |

36% |

|

Finance & accounting |

40% |

44% |

41% |

|

Manufacturing |

35% |

34% |

48% |

|

Legal |

33% |

41% |

40% |

|

Retail |

28% |

20% |

29% |

|

Construction |

27% |

18% |

26% |

|

Real estate |

27% |

32% |

24% |

|

Hospitality & leisure |

26% |

31% |

34% |

|

Transport & distribution |

24% |

30% |

29% |

|

Agriculture |

11% |

25% |

12% |

Note to editors

The research was conducted by YouGov among a representative sample of 1,313 small business decision makers on 4 October 2022, spanning all key industry sectors.