Scottish small businesses amongst regions least likely to predict growth this quarter, as economic uncertainty continues

Tuesday 14th March 2023

Small businesses in Scotland are among the least likely to predict growth of any region in the UK according to new research from Novuna Business Finance.

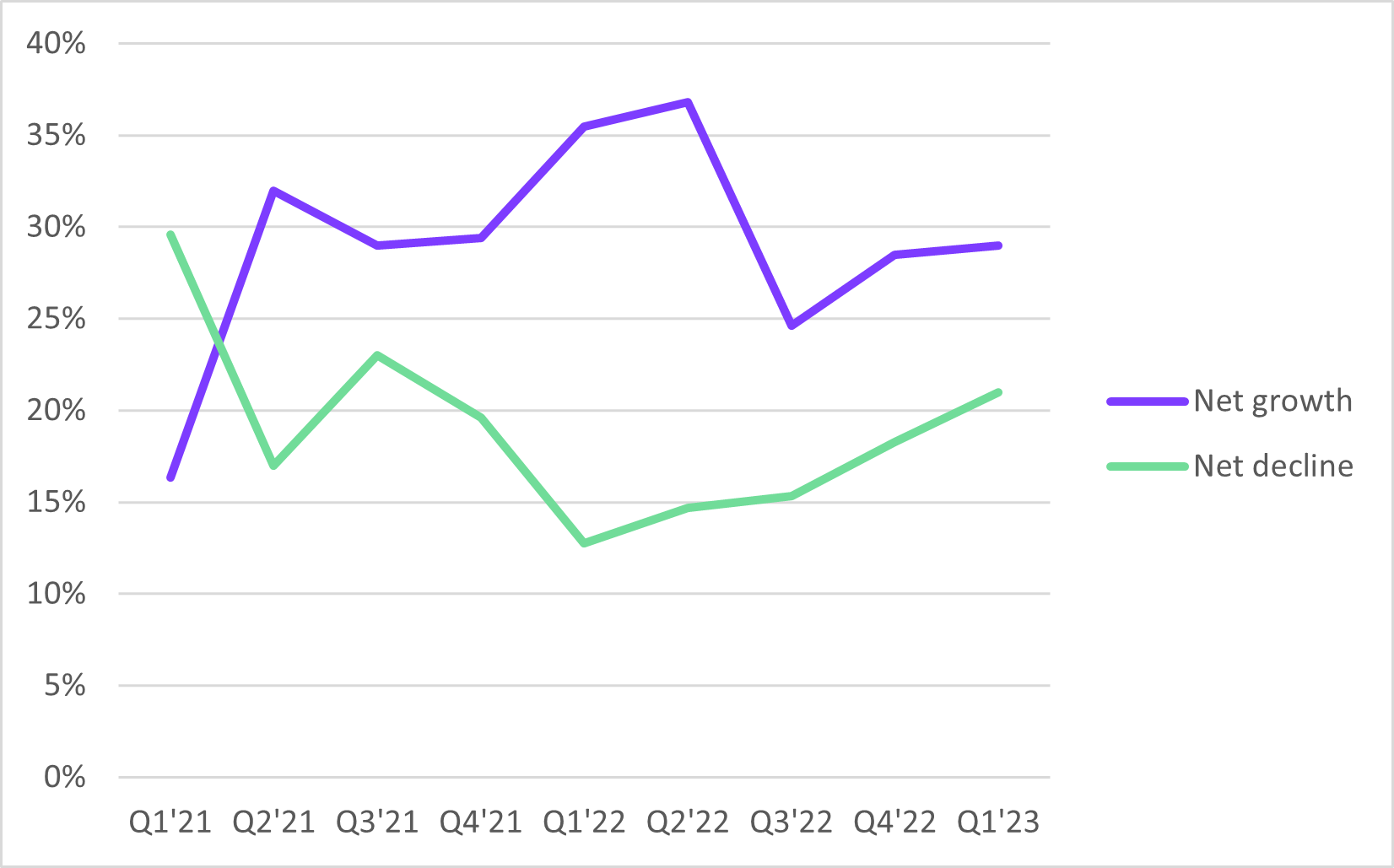

Asking a representative sample of 1,000 small businesses across the UK about their growth outlook for the next three months, the results showed that 28% of businesses in Scotland said they anticipated either strong or modest growth. By comparison, this was significantly below the national average of 33% and significantly behind other UK regions such as London (41%), and the Midlands (35%).

Compared with previous quarters, this figure was 17% lower than in Q1’22 (35%) and remains stagnant on last quarter (29%). Meanwhile, the number of small businesses anticipating contraction increased to its highest proportion in the last six quarters.

Brexit and staff shortages some of the top concerns for Scottish SMEs

At a time when there are a number of concerns plaguing the small business community, Novuna asked small business owners and senior decision makers which in particular were keeping them awake at night.

When it came to which concerns were front of mind, general economic volatility came top, with the proportion concerned about this jumping from 26% in Q1’22 to 37% now. Other concerns that had increased in the last year included retaining business (25%, +1%), and tax and interest rates (24%, +3%).

In comparison to other regions, Scottish businesses were among the most likely to be concerned about the impact of Brexit on their business. 22% said this was a major concern (vs 18% NA). Additionally, Scottish businesses were more likely than average to be concerned about recruitment (19% vs 14% NA), employee skill gap (19% vs 15% NA).

Severe headwinds of an uncertain economic environment, spiralling inflation, and high energy costs are presenting a particularly challenging playing field for businesses, which we see in our research. The growth outlook for many businesses remains modest as they see out this rough weather. While this endures, it is important not to lose sight of the longer term horizon. Whether growing, restructuring or consolidating, every business needs a plan and Novuna Business Finance will be there to support established enterprises that are working on strategies to adapt, grow and fulfil their potential despite the enormously challenging context.

Jo Morris

Head of Insight

Novuna Business Finance

Additional tables

Growth outlook by region

|

|

Growth |

Contract |

|

London |

42% |

7% |

|

North West |

35% |

15% |

|

West Midlands |

34% |

12% |

|

South East |

31% |

11% |

|

Wales |

30% |

13% |

|

East Midlands |

30% |

14% |

|

South West |

29% |

15% |

|

North East |

29% |

14% |

|

Scotland |

28% |

12% |

|

East of England |

25% |

8% |

|

Yorkshire and the Humber |

24% |

5% |

Which concerns were keeping Scottish enterprises awake at night (Year on Year) comparison):

|

|

Q1'22 |

Q1'23 |

(+/-) |

|

General economic volatility |

26% |

37% |

11% |

|

Retaining business |

24% |

25% |

1% |

|

Tax and interest rates |

21% |

24% |

3% |

|

The impact of Brexit on my business |

26% |

22% |

-4% |

|

Red tape (i.e. excessive bureaucracy and regulation) |

18% |

18% |

0% |

|

Managing cash flow |

19% |

15% |

-4% |

|

Recruitment |

15% |

14% |

-1% |

|

Employee skill gaps and shortages |

12% |

14% |

2% |

|

Compliance and Regulations |

19% |

12% |

-7% |

|

The longer-term economic impact of Covid on my business |

26% |

12% |

-14% |

|

Other |

6% |

12% |

6% |

|

Business rates |

11% |

11% |

0% |

|

The effects of unpredictable/ extreme weather |

11% |

10% |

-1% |

|

The current public health impact of Covid on my business (i.e. restrictions and social distancing rules and government advise for people to work from home) |

23% |

7% |

-16% |

|

Bad debts |

7% |

5% |

-2% |

|

Borrowing and lending |

5% |

5% |

0% |

|

Don't know |

1% |

3% |

2% |

|

Considering better finance options |

3% |

0% |

-3% |

|

Not applicable – Nothing about my business is currently keeping me awake at night |

21% |

25% |

4% |

Note to editors

The research was conducted by YouGov among a representative sample of 1,106 small business decision makers, spanning all key industry sectors.